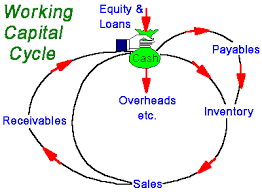

Figures generated / kept in accordance to accounting principle is prepared on accrual basis. For instance, accountant record the provision for warranty ( based on estimate) even though there's no actual cash/ economic outflow yet.

In finance, cash basis figures are more relatively more valuable , as compared to accrual basis ( advocated by accounting principle), in order to value a business.

What do you think ? You prefer a an accrual method or cash method in valuing a business?

In finance, cash basis figures are more relatively more valuable , as compared to accrual basis ( advocated by accounting principle), in order to value a business.

What do you think ? You prefer a an accrual method or cash method in valuing a business?